BMO Says Ontario Real Estate Is Repeating the 2007 U.S. Housing Crash — What This Means for You

Last updated October 20, 2025 · Join our GTA Market Newsletter

Summary: BMO says Ontario’s housing market is mirroring the 2007 U.S. crash pattern. GTA average prices fell from $1,349,033 (Feb 2022) to $1,062,984 (Sept 2025) — a 21.2% decline. Expect lowering of prices, driven by affordability, credit conditions, inventory, and sentiment. Below: what this means for buyers, sellers, and investors in the GTA.

Ontario’s not about to correct — it’s already been correcting for three years. And if you’ve been watching prices, you can feel it. The market’s slower, more cautious, and BMO Capital Markets just confirmed what many agents, investors, and homeowners have quietly sensed: this isn’t a temporary dip. It’s a multi-year correction that’s already well underway.

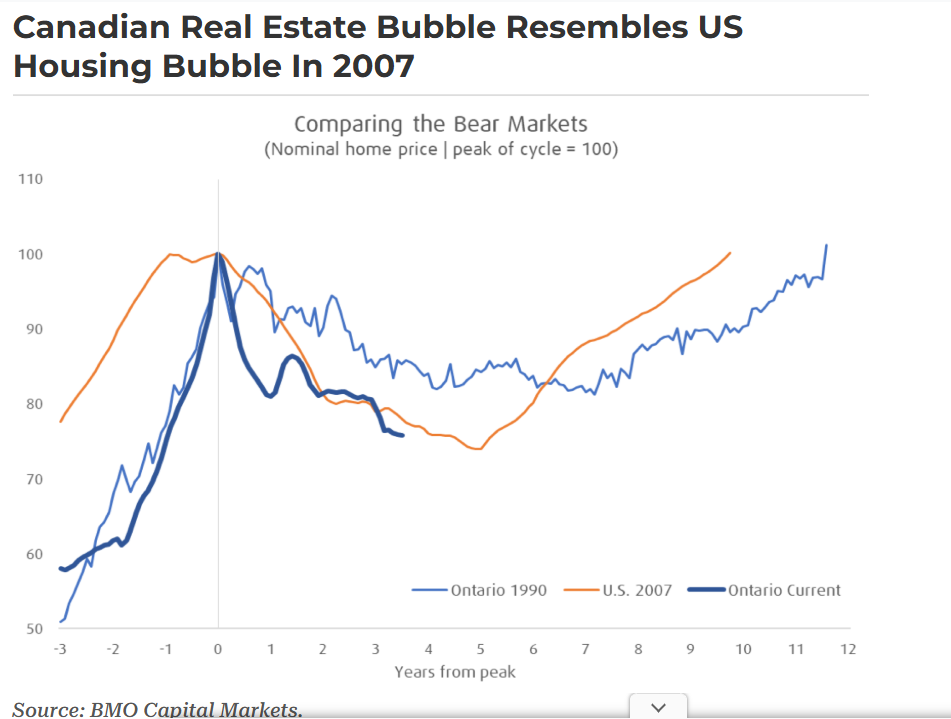

According to BMO Senior Economist Robert Kavcic, the Canadian housing market — and Ontario in particular — is now mirroring the same price trajectory that the U.S. housing market followed leading up to and after the 2007 crash.

📉 BMO: The Bubble Has Already Been Deflating for Three Years

“While many are searching for bubbles in the equity market, one continues to undo itself as we speak — Canadian real estate.”

And the data shows no sign that this cycle is done correcting. marking a slow path forward of removing excess inflation of pices — echoing the pattern of the U.S. housing market after 2007, which took nearly a decade to fully recover.

🏠 Why BMO Says This Looks Like 2007

What’s actually similar between Ontario today and the U.S. in 2007? Not subprime loans — Canadian banks are far more conservative. It’s about the pattern, the psychology, and the duration:

- Prices peaked in early 2022, similar to the U.S. in 2006–07.

- Declines persisted 3+ years despite strong population growth — a classic sign that affordability, not demographics, is in the driver’s seat.

- Trajectory mirrors both the U.S. crash curve and Ontario’s 1990s downturn — gradual deflation, not a single “pop.”

💥 The Textbook Bubble Playbook

- Displacement — Ultra-low rates, pandemic migration, cheap credit.

- Boom — Prices climb, media attention surges, FOMO builds.

- Euphoria — Bidding wars, “buy now or never,” price expectations detach from rents/incomes.

- Profit-Taking — Smart money exits, DOM creeps up, buyers hesitate.

- Panic/Bust — Reality sets in; demand cools; prices drift back to fundamentals.

🧠 “Time to Realign” — In Plain English

Translation: this isn’t a quick dip with a springy rebound. It’s a multi-year reset where prices, incomes, rents, and financing costs need time to realign. Markets can’t rise 40–50% in two years and reset in two quarters — the timing simply doesn’t pencil.

📊 GTA Average Price: Peak vs. Now

| Date | Average GTA Home Price | % Change from Peak |

|---|---|---|

| Feb 2022 (Peak) | $1,349,033 | — |

| Sept 2025 | $1,062,984 | ↓ 21.2% |

That 21% decline sounds dramatic, but zoom out: prices are still well above 2015 levels. What’s happening is normalization of affordability, not collapse.

🔍 The “Perfect Storm” That Can’t Be Recreated

- Peak millennial demand

- Record immigration + pandemic migration

- Ultra-low rates and excess liquidity

- Maxed-out valuations + speculative psychology

That cocktail made real estate feel unstoppable. Those conditions are gone — and, as BMO puts it, “next to impossible to repeat.”

🧮 Why Prices Could Stay Under Pressure

- Unemployment & incomes — rising joblessness dents demand.

- High interest rates — renewals at 5–6% strain budgets.

- Tighter credit — OSFI rules curb borrowing power.

- Rising inventory — MOI moving toward buyer’s market zones.

- New completions — 2025–26 condo deliveries add supply.

- Falling confidence — “wait for lower” stalls transactions.

- Rental softness — flat rents break investor math.

- Population shifts — slower NPR inflows reduce pressure.

- Debt stress — delinquencies/insolvencies up at the margin.

- Buyer psychology — caution keeps demand on ice.

🧭 What To Do Now (Buyers, Sellers, Investors)

Buyers

Don’t chase “the bottom.” Chase resilient math: payment you can carry with buffer; hold 5–7 years. Consider income-additive layouts (legal suites/laneway opportunities).

Sellers

Price for the market you have. First two weeks matter most. Stage, pre-inspect, disclose. Create certainty; certainty gets offers.

Investors

Cash flow beats hope. Target properties that work day one near transit/employment nodes. Focus on execution: suite legalization, energy efficiency, operations.

💬 So, Is BMO Right?

Somewhat — not in a doom-and-gloom way, but as a realistic read. This is a slow normalization, not a 2007-style banking crisis. The psychology and path rhyme; the plumbing (lending/underwriting) is different.

🏁 Final Thoughts

If this pattern holds, it could take another five years to get our footing back on prices. But who wants 2022 pricing? What we need is 2025 affordability and 2025 opportunity. The winners in this phase use data, structure smart debt, and buy utility — not headlines.

📞 Book a free strategy call with the Ragona Sisters:

https://calendly.com/ragonateam

📰 Join our Newsletter for weekly GTA market updates:

https://ragonasisters.ca/join-the-ragona-sisters-insider-updates-1

FAQ: Ontario & GTA Housing in 2025

Is Ontario’s housing market crashing?

It’s correcting. GTA average prices are down ~21% from the Feb 2022 peak, but this is a multi-year normalization, not a systemic banking crisis.

How long will the correction last?

BMO’s framing is “years, not months.” If the pattern holds, regaining 2022 levels could take multiple years.

Should I buy now or wait?

If you can secure resilient cash flow or a payment you can comfortably carry for 5–7 years, buying a quality asset now can make sense. Time in market beats perfect timing.

What’s the biggest risk ahead?

Affordability via rates/renewals, plus inventory and sentiment. Watch MOI, credit conditions, and labour trends.