Secrets to Paying Less Interest on Your Mortgage &

Paying It Off Sooner

A mortgage is often the largest financial commitment most people will ever make. While the thought of paying for 25-30 years might seem overwhelming, there are strategies that can help you reduce interest costs and pay off your mortgage much faster.

What if you could own your home outright years sooner and save tens (or even hundreds) of thousands of dollars in interest? 🚀

In this guide, I’ll share some of the best-kept secrets to paying less mortgage interest and achieving financial freedom faster!

1️⃣ Opt for a Shorter Loan Term ⏳

One of the easiest ways to cut down mortgage interest is to choose a shorter-term loan.

• A 30-year mortgage may seem more affordable, but it comes at a steep price in interest.

• A 15-year mortgage has higher monthly payments, but it reduces the total interest paid by tens or hundreds of thousands of dollars.

Example: 30-Year vs. 15-Year Mortgage 💡

Example: 30-Year vs. 15-Year Mortgage 💡

Let’s assume you take out a $400,000 mortgage with a 5% interest rate:

• 30-year loan: You’ll pay $373,023 in interest over the life of the loan.

• 15-year loan: You’ll pay only $169,685 in interest—saving over $200,000!

Even if you already have a 30-year mortgage, you can use extra payments (which I’ll explain below) to mimic a shorter loan term!

2️⃣ Make Biweekly Payments Instead of Monthly 📆

Most people make 12 mortgage payments per year. However, if you switch to biweekly payments, you’ll make 26 half-payments annually, which is equivalent to 13 full payments instead of 12.

That one extra payment per year might seem small, but it can shave off years from your mortgage and save you thousands in interest!

Example: How Biweekly Payments Save You Money

Example: How Biweekly Payments Save You Money

🔹 On a $300,000 mortgage at 4% interest, biweekly payments can:

✅ Reduce your mortgage term from 30 years to about 25 years ⏳

✅ Save you $34,000+ in interest 💰

If your lender doesn’t allow biweekly payments, simply make one extra payment per year on your own to achieve similar savings!

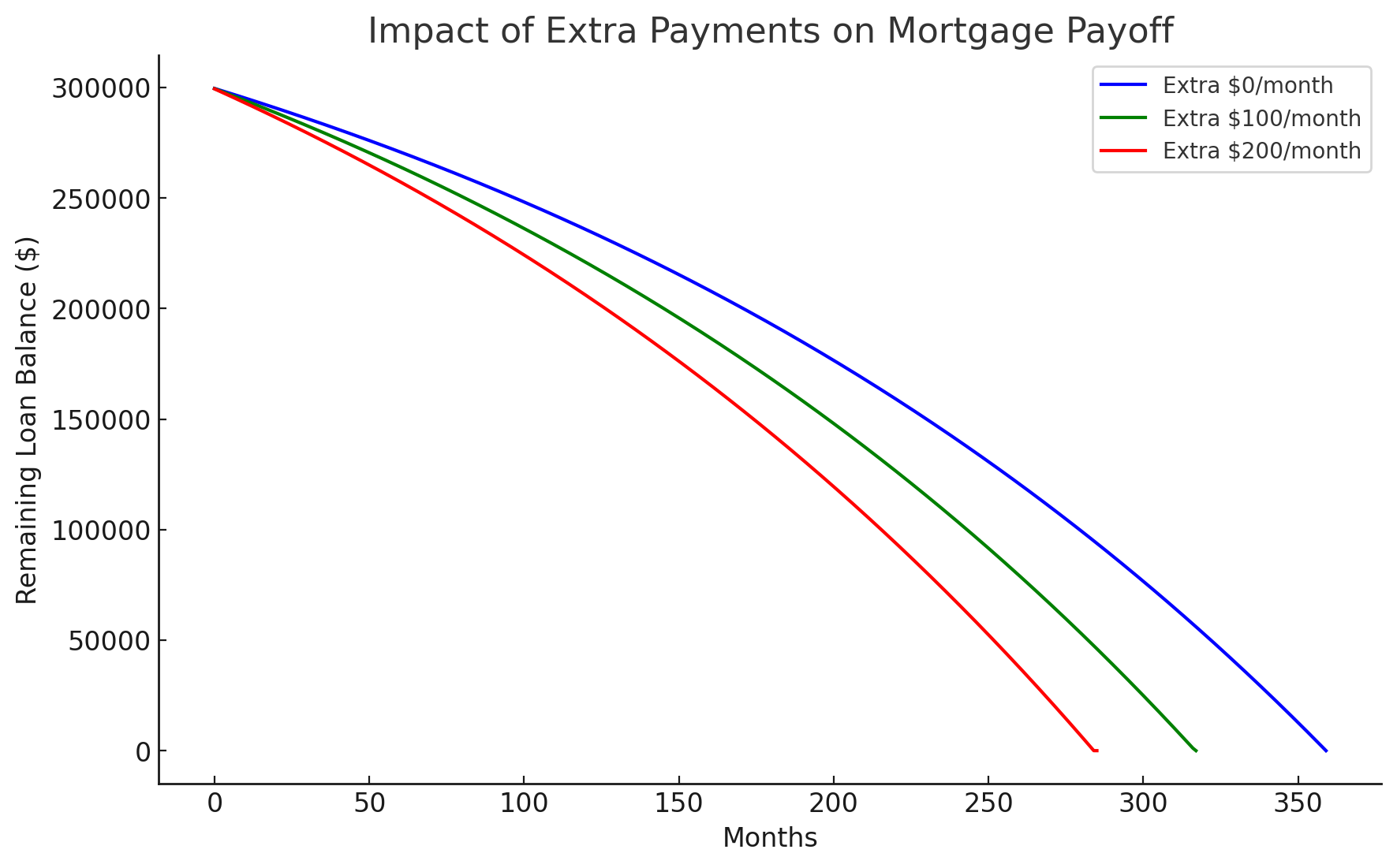

3️⃣ Increase Your Monthly Payment Amount 💸

Even a small extra payment each month can significantly impact your mortgage.

• Let’s say your mortgage payment is $1,500 per month.

• If you round it up to $1,600, that extra $100 per month could:

✅ Save thousands in interest

✅ Cut years off your loan term

Real-World Example: The Power of an Extra $100/Month

Real-World Example: The Power of an Extra $100/Month

🔹 On a $250,000 mortgage at 5% interest, paying just $100 extra per month could:

✅ Shorten your mortgage by 5 years

✅ Save you over $40,000 in interest

💡 Pro Tip: Use mortgage calculators to experiment with different extra payment amounts!

4️⃣ Make Lump-Sum Payments Whenever Possible 🏦

If you ever come into extra money, consider putting it toward your mortgage!

✅ Tax refunds

✅ Work bonuses

✅ Side hustle income

✅ Inheritance or financial gifts

Every lump-sum payment lowers your principal balance and helps you pay off your mortgage faster!

Even a one-time extra payment of $5,000 can save you thousands in interest over the life of the loan.

5️⃣ Refinance to a Lower Interest Rate 🔄

If mortgage rates drop, refinancing could lower your interest costs and help you pay off your mortgage faster!

When Should You Refinance?

✅ If the new interest rate is at least 1% lower than your current rate 📉

✅ If you plan to stay in your home long enough to recover closing costs 💰

✅ If you want to switch from a 30-year to a 15-year loan ⏳

Example: Refinancing Savings

Example: Refinancing Savings

If you refinance a $400,000 mortgage from 6% down to 5%, you could:

✅ Save $91,000 in interest

✅ Reduce your monthly payment significantly

However, refinancing comes with closing costs, so crunch the numbers before making the move!

6️⃣ Use a Mortgage Offset Account (If Available) 🏦

Some lenders offer mortgage offset accounts, which allow you to reduce the interest you pay.

How It Works:

Your mortgage interest is calculated based on your loan balance minus your savings balance.

🔹 Example: If you have $10,000 in an offset account and a $300,000 mortgage, you only pay interest on $290,000 instead of $300,000!

If your lender offers this feature, take advantage of it!

7️⃣ Avoid Private Mortgage Insurance (PMI) 🏠🚫

If you bought your home with less than 20% down, you’re probably paying PMI, which can cost hundreds of dollars per month!

To eliminate PMI:

✅ Pay down your mortgage to reach 20% equity 📉

✅ Ask your lender to remove PMI once eligible

✅ Refinance if your home value has significantly increased

This simple step can free up money that you can redirect toward extra mortgage payments!

8️⃣ Recast Your Mortgage Instead of Refinancing 🔁

If you receive a large sum of money (like an inheritance or bonus), you might consider a mortgage recast instead of refinancing.

🔹 Recasting means making a large lump-sum payment, and your lender recalculates your monthly payments based on the lower balance—without changing your interest rate!

Benefits of Recasting:

Benefits of Recasting:

✅ Lower monthly payments 💸

✅ No need to requalify like refinancing 🏡

✅ Keeps your low interest rate if rates have risen

If your lender allows recasting, it’s a great way to reduce mortgage costs without refinancing!

🔟 The Power of Mindset & Discipline 🧠💪

Paying off your mortgage early requires commitment and consistency. Here’s how to stay motivated:

✅ Visualize a mortgage-free life—Imagine the financial freedom!

✅ Set small goals—Aim for one extra payment per year.

✅ Use mortgage payoff calculators to see progress in real time.

✅ Celebrate milestones—Every extra payment gets you closer! 🎉

💡 Final Thoughts: Your Path to Mortgage Freedom

By implementing these secrets, you can:

✅ Own your home years sooner ⏳

✅ Save tens (or hundreds) of thousands in interest 💰

✅ Achieve true financial freedom faster 🚀

The key is consistency—small changes add up to big savings over time.

Which strategy will you try first? Drop your thoughts below! ⬇️