Your credit score is more than just a number—it’s your financial reputation. Whether you’re applying for a mortgage, auto loan, renting an apartment, or even getting a job, your credit score plays a crucial role in determining your opportunities.

A low score can cost you thousands of dollars, while a high score can save you money and open up financial doors. In this comprehensive guide, we’ll explore:

✅ What a credit score is and how it works

✅ How it affects major financial decisions

✅ A step-by-step guide to improving your credit score

✅ Common credit myths and mistakes to avoid

✅ Real-life examples showing the impact of credit scores

Let’s dive in and take control of your financial future! 🚀💰

🔎 What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. It’s based on your financial history, including how you pay your bills, how much debt you have, and the length of your credit history.

The most commonly used model is the FICO Score, which ranges from 300 to 850:

📉 300 - 579: Poor – 🚨 Very high risk

😬 580 - 669: Fair – ⚠️ Some risk involved

🙂 670 - 739: Good – ✅ Reliable borrower

😃 740 - 799: Very Good – 🔥 Great financial habits

🎉 800 - 850: Excellent – 💎 Top-tier borrower

💡 How Is Your Credit Score Calculated?

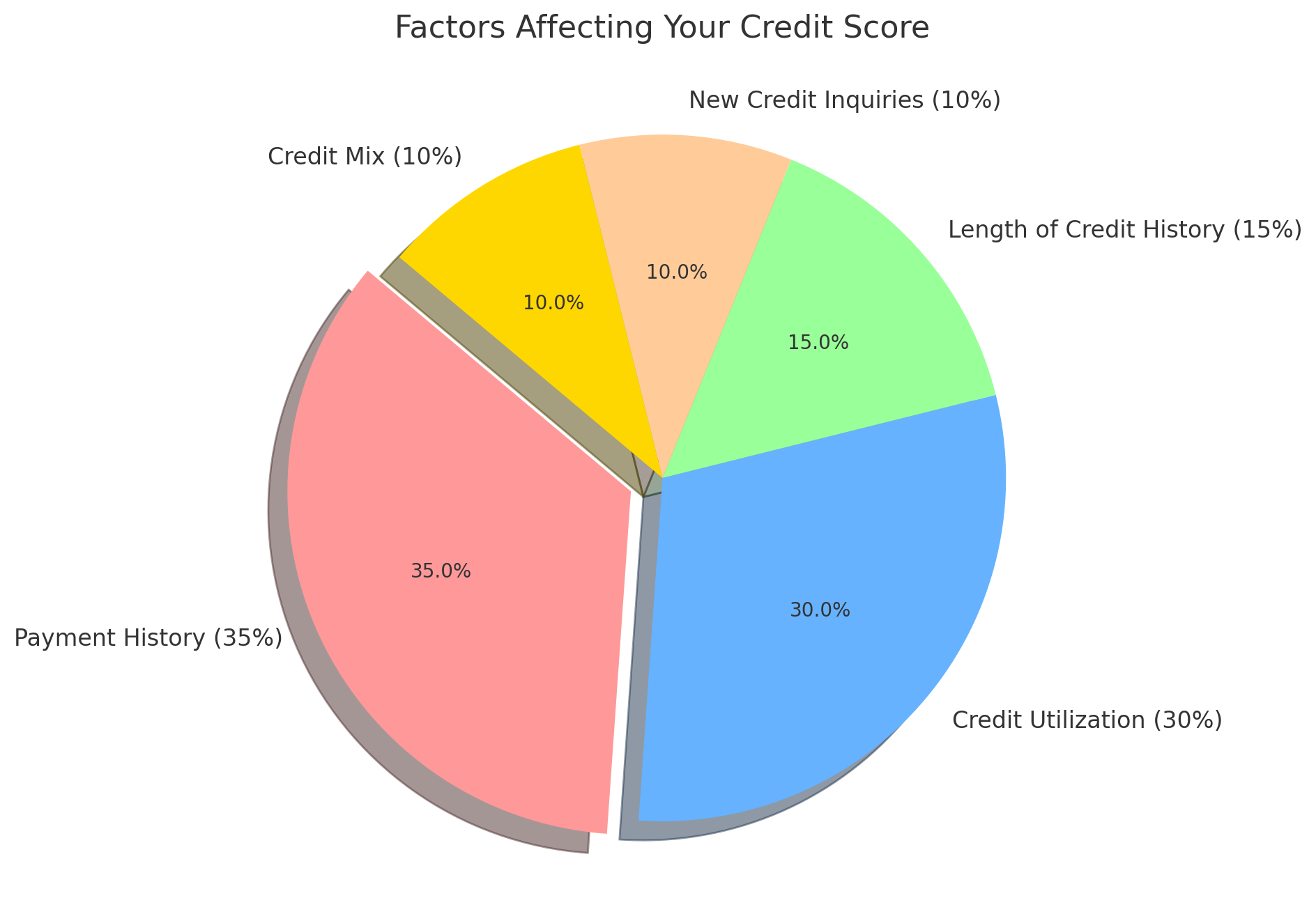

Your credit score is based on 5 key factors:

Factor Percentage Impact

Payment History 35% 📆 Most important! Pay on time!

Credit Utilization 30% 💳 Keep balances low (below 30% of limit).

Length of Credit History 15% ⏳ Longer credit history = better score.

New Credit Inquiries 10% 🚨 Too many applications hurt your score.

Credit Mix 10% 🔄 Variety of credit types helps your score.

🏡 Buying a Home: The Make-or-Break Factor

Your credit score plays a huge role in getting a mortgage.

💰 Low Score Consequences:

❌ Higher interest rates (costing you tens of thousands in extra payments)

❌ Larger down payment requirements

❌ Higher risk of loan rejection

💰 High Score Benefits:

✅ Lower interest rates (saving you money)

✅ Better loan terms

✅ Easier approval for home loans

Example: The Cost of a Low Score

__________________________________________________

Imagine you’re getting a $300,000 mortgage loan for 30 years:

Credit Score Interest Rate Monthly Payment Total Interest Paid

800+ 4.5% $1,520 $247,220

670-739 5.5% $1,700 $311,660

580-669 7.5% $2,100 $455,332

__________________________________________________

😱 A lower score could cost you over $200,000 extra in interest!

🚗 Car Loans & Auto Insurance: Paying More or Less?

Your credit score affects:

🚗 Car loan approval & interest rates

🔍 Auto insurance premiums

__________________________________________________

💡 Example: $25,000 Car Loan for 5 Years

Credit Score Interest Rate Monthly Payment Total Interest Paid

750+ 4.0% $460 $2,600

600-650 12.0% $550 $8,000

__________________________________________________

📉 Bad Credit? Pay thousands more for the same car!

🏢 Renting an Apartment: Landlords Check Your Credit!

Most landlords check credit scores before approving tenants.

📉 Low Credit Score Consequences:

❌ Higher security deposit

❌ Rejection from competitive rental markets

❌ Need for a co-signer

📈 High Credit Score Benefits:

✅ Lower security deposit

✅ Easier approval process

✅ Ability to rent in high-demand areas

📱 Getting a Phone Plan: No Credit, No Contract?

Many mobile carriers check credit scores before allowing you to finance

a new phone or get a contract plan.

😱 Low Credit Score = Hefty Deposits or Prepaid Plans

💰 High Credit Score = Zero-Down Phone Financing

💼 Job Opportunities: Some Employers Check Your Credit

Certain jobs (finance, security, government) require credit checks as part of background screening.

📉 Bad credit can hurt job prospects, especially in positions handling money.

🚀 How to Improve Your Credit Score

Step 1: Pay Your Bills on Time

✅ Set up auto-pay or reminders

Step 2: Lower Your Credit Utilization

✅ Keep balances below 30% of your total credit limit

Step 3: Don’t Close Old Accounts

✅ A longer credit history helps improve your score

Step 4: Limit Hard Inquiries

✅ Space out applications over time

Step 5: Diversify Your Credit Mix

✅ Lenders like to see a mix of credit types

Step 6: Check Your Credit Report for Errors

✅ Get free annual credit reports from Equifax, TransUnion, and Experian

🤯 Common Credit Myths Debunked!

🚫 “Checking my credit hurts my score.” FALSE!

✅ Checking your own score (soft inquiry) doesn’t affect your credit.

🚫 “I have no debt, so I must have a great score.” FALSE!

✅ You need active credit accounts to build a good score.

🚫 “Closing a credit card helps my credit.” FALSE!

✅ It can actually lower your score by shortening your credit history.

🎯 Final Thoughts: Take Control of Your Financial Future!

Your credit score isn’t just a number—it’s the key to better financial opportunities. By understanding how it works and taking steps to improve it, you can save money, reduce stress, and unlock financial freedom.

So, take action today and watch your financial future shine brighter than ever! 🚀💰💳