Unexpected Expenses When Purchasing a Home: A Comprehensive Guide

Buying a home is an exciting milestone! 🎉 You’ve probably spent months searching for the perfect property, negotiating with sellers, and imagining yourself living in your dream home. But before you pop the champagne 🍾, let’s talk about something that often catches homebuyers off guard—the hidden costs of homeownership!

Sure, you’ve budgeted for the down payment and mortgage, but have you factored in all the extra expenses? 🤔 If not, don’t worry—I’ve got you covered! This guide will walk you through the sneaky costs of buying a home so you’re fully prepared before signing on the dotted line. ✍️

1. Closing Costs: More Than Just a Signature! 📝💸

Many first-time buyers focus on the down payment, but closing costs can be a shock. Typically ranging from 2% to 5% of your home’s purchase price, these fees add up quickly! 😱

What’s Included in Closing Costs?

✅ Legal Fees – You’ll need a real estate lawyer to review contracts, ensure proper title transfer, and handle paperwork. 💼

✅ Land Transfer Tax – Depending on your location, this can be thousands of dollars. 🏛️

✅ Title Insurance – Protects you from ownership disputes or hidden claims on the property. 🔏

✅ Home Inspection & Appraisal – Required by lenders to ensure the home’s value matches the loan amount. 🔍

✅ Mortgage Insurance (CMHC in Canada, PMI in the U.S.) – If your down payment is less than 20%, expect to pay extra monthly premiums. 😬

Real-Life Example

Imagine buying a $500,000 home. If closing costs are around 4%, that’s an extra $20,000 due at closing! If you haven’t budgeted for this, it can be a major financial surprise.

💡 Pro Tip: Always ask your lender for a detailed breakdown of closing costs so there are no surprises! 📊

2. Property Taxes: A Bill That Never Stops Coming! 🏛️

2. Property Taxes: A Bill That Never Stops Coming! 🏛️

Your home might be paid off in 25 years, but property taxes? Those never go away! 🚨

Most municipalities charge property taxes based on your home’s assessed value, and these can range from a few hundred to several thousand dollars per year! 📆

What Can You Expect?

✔️ Higher property taxes in cities – Urban areas tend to have higher rates. 🌆

✔️ Suburban and rural areas may have lower taxes – But not always. 🚜🏡

✔️ Taxes increase over time – As home values go up, so do property taxes. 📈

Real-Life Example

Let’s say you buy a $500,000 home in an area with a 1.5% tax rate. That’s $7,500 per year, or about $625 per month—which is like an extra mortgage payment! 😲

💡 Pro Tip: Check the home’s previous tax records to see how much you’ll need to budget each year! 📑

3. Homeowners Insurance: The Non-Negotiable Expense! 🔥🚒

3. Homeowners Insurance: The Non-Negotiable Expense! 🔥🚒

Your lender requires homeowners insurance, but even if they didn’t, you wouldn’t want to skip this! 🏠

What Homeowners Insurance Covers

✅ Fire, theft, and natural disasters 🌪️

✅ Liability coverage if someone gets injured on your property 🚑

✅ Replacement cost for belongings 🏡💰

How Much Does It Cost?

The price of home insurance depends on:

🏠 Home size and value – Bigger homes = higher premiums.

📍 Location – If you live in an area prone to flooding, wildfires, or earthquakes, expect to pay more.

🔧 Age and condition of the home – Older homes may cost more to insure due to maintenance risks.

💡 Pro Tip: Compare different insurance providers to get the best rate. Don’t just go with the first one your lender suggests! 📉

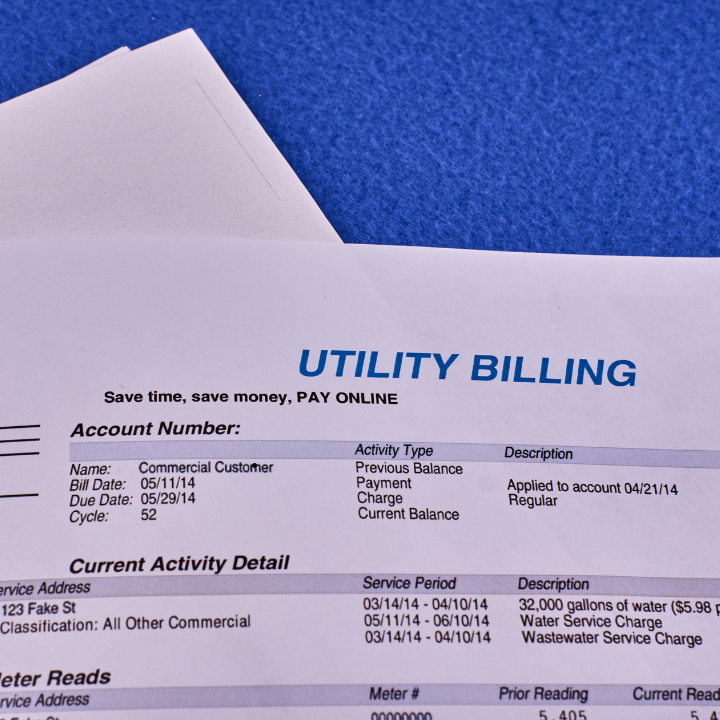

4. Utility Bills: It’s More Than Just Electricity! 💡🔥💧

4. Utility Bills: It’s More Than Just Electricity! 💡🔥💧

When you rent, you might only pay for hydro and internet. But as a homeowner? The bills pile up FAST! 💸

What Bills Should You Expect?

🔹 Electricity & Water – Bigger homes = higher utility bills. ⚡

🔹 Heating & Cooling – Older homes may cost more to heat in winter. ❄️🔥

🔹 Garbage & Recycling Fees – Some cities charge separately for this. 🗑️

🔹 Internet, Cable, and Phone – Prices keep rising every year! 📶

Real-Life Example

A friend of mine moved into a 3-bedroom house and was shocked when their winter heating bill hit $400/month. Always budget more than you think for utilities!

💡 Pro Tip: Ask the seller for recent utility bills so you can estimate your monthly costs. 📊

5. Maintenance & Repairs: The “Oh No” Fund! 🛠️💵

5. Maintenance & Repairs: The “Oh No” Fund! 🛠️💵

Unlike renting, where a landlord fixes things, YOU are now responsible for everything! 😨

Common Expenses

🏠 Roof Repairs – Costs can range from $5,000 to $15,000+! ☔

🚰 Plumbing Issues – A burst pipe could set you back $1,000+!

🔄 Appliance Replacements – Fridge, stove, washer? They all wear out over time.

Real-Life Example

One homeowner I know had their furnace break in the middle of winter. The repair bill? $3,500—completely unexpected. Always have an emergency fund!

💡 Pro Tip: Set aside at least 1% of your home’s value annually for repairs.

6. Moving Costs: It’s More Than Just Gas Money! 🚛💨

6. Moving Costs: It’s More Than Just Gas Money! 🚛💨

Even if you’re moving across town, moving isn’t cheap!

🚛 Professional Movers – Expect to pay $1,000+ for local moves, more for long distances.

📦 Packing Supplies – Boxes, tape, bubble wrap… they add up!

🚗 Storage Units – If your move-in dates don’t align, you may need a storage unit.

💡 Pro Tip: If you’re on a budget, consider renting a truck and asking friends for help! 🍕💪

Final Thoughts: Plan for the Unexpected! 🏠💵

Buying a home is a huge investment, and the hidden costs can be overwhelming if you’re not prepared. But with the right budgeting strategy, you can avoid financial stress and enjoy your new home! 🏡🎉

✅ Here’s Your Action Plan:

✔️ Save an extra 3-6 months’ worth of expenses before buying.

✔️ Get multiple quotes for insurance, utilities, and moving services.

✔️ Have a rainy-day fund for unexpected repairs! ☔

🏡 Homeownership is rewarding, but planning ahead ensures it’s a dream—not a financial nightmare! 💙

Did you find this guide helpful? Let me know in the comments! 👇💬